This seemingly subtle shift can translate into significant savings. In fact, you could pocket approximately $1,109.20 in interest savings and liberate yourself from the car loan nearly 9 months earlier.

Loans and mortgages are formidable financial commitments that often linger for years, if not decades, casting a long shadow over your financial landscape. The interest accrued during this extended period can be overwhelming. Fortunately, there’s a potent financial strategy that can turbocharge your efforts to settle your car loan or mortgage faster while keeping more money in your pocket: embracing bi-weekly payments. Let’s delve into the art of bi-weekly payments and how they can expedite debt repayment, reduce the interest burden, and pave the way for substantial savings.

The Impact of Increased Payment Frequency

Switching to bi-weekly payments transforms the game. Rather than making 12 monthly payments, you’ll be making 26 half-payments each year, equivalent to 13 full payments. This seemingly small shift results in an extra payment annually, a payment that wields the singular purpose of hacking away at your principal debt, supercharging your journey to debt freedom.

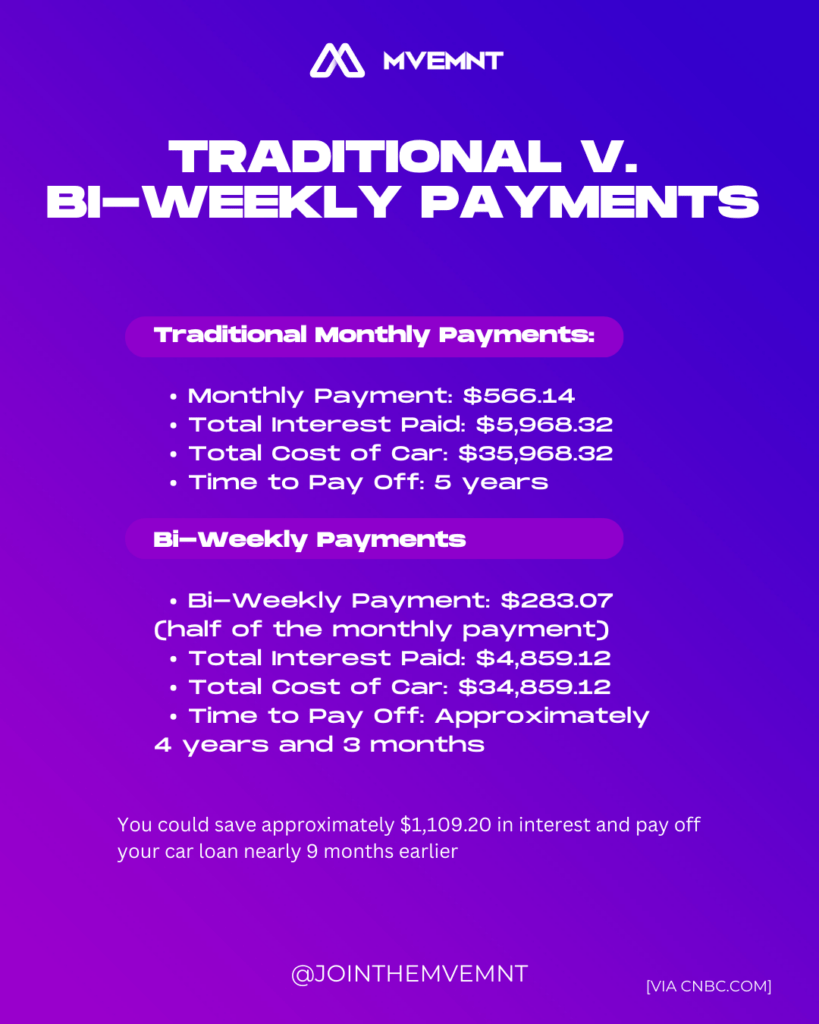

Let’s illustrate this with a practical example. Imagine you have a $30,000 car loan with a 5-year (60-month) term at an interest rate of 5%. Under the conventional monthly payment schedule, you’d owe approximately $566.14 per month. Over the life of the loan, this translates to a staggering $5,968.32 in interest payments, bringing the total cost of the car to $35,968.32.

Now, let’s consider the power of bi-weekly payments. By splitting your payments into 26 half-payments annually, your bi-weekly installment drops to $283.07 (half of the monthly amount). This seemingly subtle shift can translate into significant savings. In fact, you could pocket approximately $1,109.20 in interest savings and liberate yourself from the car loan nearly 9 months earlier, with a total cost of $34,859.12. This vividly demonstrates the transformative impact of increased payment frequency on the cost of your debt and the velocity of your journey to financial liberation.

The Magic of Interest Savings

Bi-weekly payments reduce the average daily balance on your loan, thereby diminishing the interest that accrues. It’s simple mathematics – two smaller payments instead of one substantial monthly payment lead to a more manageable principal balance and reduced interest expenses. It’s a powerful strategy for anyone seeking to optimize their financial outlook.

Enhanced Budgeting

Bi-weekly payments offer another boon: improved budgeting. By splitting your payments into two smaller, more manageable amounts, you gain greater control over your cash flow. This structure can be particularly advantageous for those who receive bi-weekly paychecks, aligning your payment schedule with your income inflow. It brings harmony to your financial life.

The Discipline of Progress

One cannot ignore the psychological advantage of bi-weekly payments. They cultivate a sense of discipline and commitment to clearing your debt. With payments occurring every two weeks, you remain constantly engaged with your financial goal, continuously motivated to adhere to the accelerated payment schedule.

Embrace the Power of Bi-Weekly Payments

The strategy of splitting your car loan or mortgage into two bi-weekly payments each month can be a formidable force in your financial arsenal. By increasing the frequency of your payments, chipping away at the principal balance, and trimming interest costs, you can attain financial freedom sooner than you ever imagined. Don’t hesitate – seize the opportunity, reach out to your lender, and commence your journey towards accelerated debt repayment and fortified financial security. Your future self will undoubtedly extend a heartfelt thanks for this wise financial move.