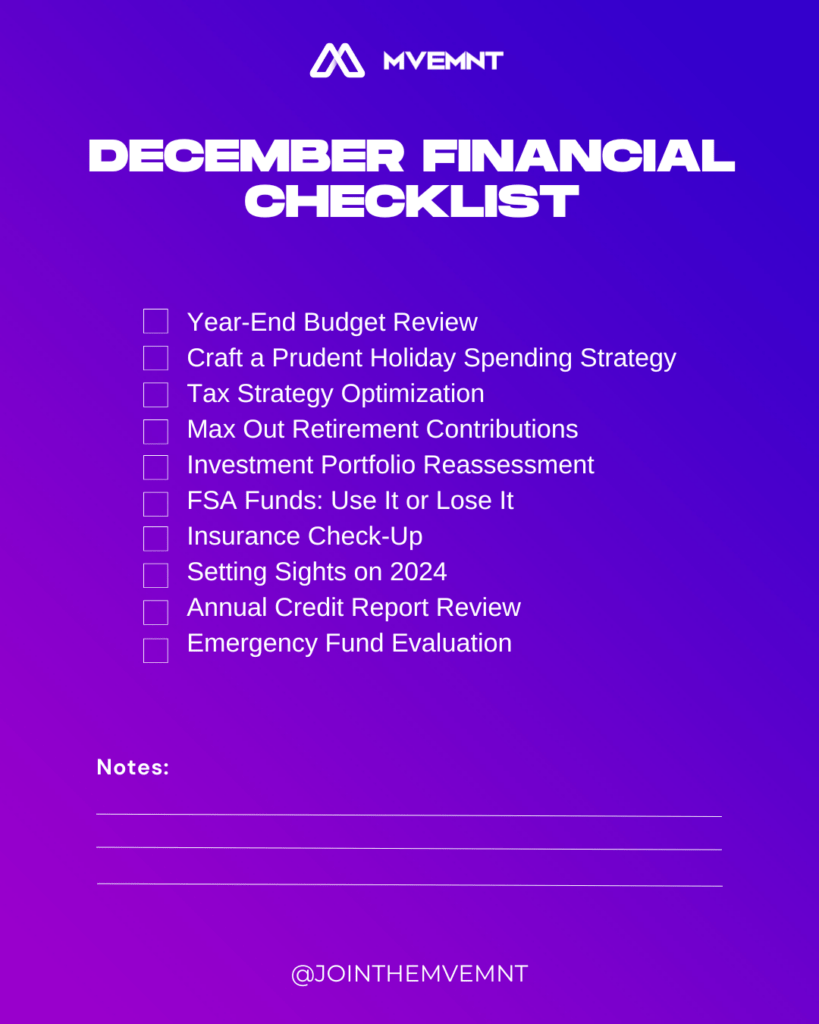

As we wind down another year, the festive cheer of December brings with it the crucial task of financial housekeeping. For those looking to enter the new year with robust financial health, this month offers a golden opportunity to make some wise financial decisions. Here’s a rundown of the top 10 financial moves you should consider before the clock strikes midnight on December 31st.

1. Year-End Budget Review: As the year draws to a close, it’s essential to take a retrospective look at your finances. Analyze your budget adherence over the past year and recalibrate for the upcoming fiscal period. This introspection is not just about numbers; it’s about understanding your financial habits and plotting a more informed path forward.

2. Craft a Prudent Holiday Spending Strategy: December’s festive allure often leads to extravagant spending. To avoid a financial hangover in January, set a realistic holiday budget. Prioritize your expenses and resist the temptation to overindulge in the spirit of the season.

3. Tax Strategy Optimization: With the tax year almost at an end, now is the time to employ last-minute strategies to lessen your tax burden. This could involve charitable contributions, deferring income, or accelerating deductions – maneuvers that require careful planning and timing.

4. Max Out Retirement Contributions: Your future self will thank you for bolstering your retirement accounts. Ensure you’ve maxed out contributions to your 401(k)s and IRAs. For those over 50, don’t forget the additional catch-up contributions you’re entitled to.

5. Investment Portfolio Reassessment: The end of the year is an opportune moment to review and potentially rebalance your investment portfolio. It’s all about aligning your investments with your risk tolerance and financial goals.

6. FSA Funds: Use It or Lose It: If you have a Flexible Spending Account, remember that these funds often come with a use-it-or-lose-it caveat. Review your balance and spend it wisely on qualifying expenses before time runs out.

7. Insurance Check-Up: Your life isn’t static, and neither should be your insurance coverage. December is a good time to review your policies – be it life, health, or property insurance – to ensure they match your current needs.

8. Setting Sights on 2024: What are your financial aspirations for the new year? Setting goals now, whether it’s saving for a home, starting a business, or cutting down debt, can give you a head start as the new year rolls in.

9. Annual Credit Report Review: Your credit score is a pivotal part of your financial identity. An annual review of your credit report can help catch any discrepancies and provide insights for improvement.

10. Emergency Fund Evaluation: Last but certainly not least, reassess your emergency fund. This financial cushion is more than just a safety net; it’s peace of mind in an unpredictable world.

In sum, December isn’t just a time for holiday festivities; it’s a crucial period for financial reflection and preparation. By taking these steps, you can ensure that you step into the new year not just with renewed energy but also with a solid financial foundation.