Written By Jamaal R.

Financial expert David Ramsay says, “You will either manage money, or the lack of it will manage you.” Most of us view wealth, if not the main, as an important life goal for various reasons. Maybe you want to travel the world when you want, buy that dream house or car, or perhaps you want to take better care of yourself and your loved ones. Whatever the reason, the goal is the same – GET MONEY and lots of it. As many of you know, the desire to attain wealth isn’t enough; you must first learn how to do it. That’s why we’ve brought you five tips to help you achieve that goal of becoming wealthy. Check them out and apply them; if you do, you will see results backed by science.

TIP #1: BUDGET

You can’t hit a target you don’t have. Look at budgeting as having a plan for your finances. If you blindly spend what you make without tracking your expenses or budgeting, it will make your life more stressful and harder to hit your financial goals. Eliminate the guesswork and get clear on your financial goals.

The MINT App will help track and plan your budget.

TIP #2: GET OUT OF DEBT

Once your debt is paid off, it will free up bundles of money in your budget and put you on the path to financial success by allowing you to begin to save serious money and build wealth. Think about if all the money you currently spend on debt was instead saved or invested. You would go from paying others to now paying yourself. Think about how great that would feel and how much more money you’d be saving!

Check out this Pay Off Debt Planner

TIP #3: LIVE BELOW YOUR MEANS

Just because you can buy it does not mean you should. Wealthy people have a habit of living well below their means. By doing this, you allow yourself the ability to save more money, pay off debt and build wealth faster. You will also find life to be less stressful because by living below your means, you tend to have more cash on hand, and this will allow you to better deal with life’s surprises and expenses that are sure to arise.

TIP #4: SAVE MONEY

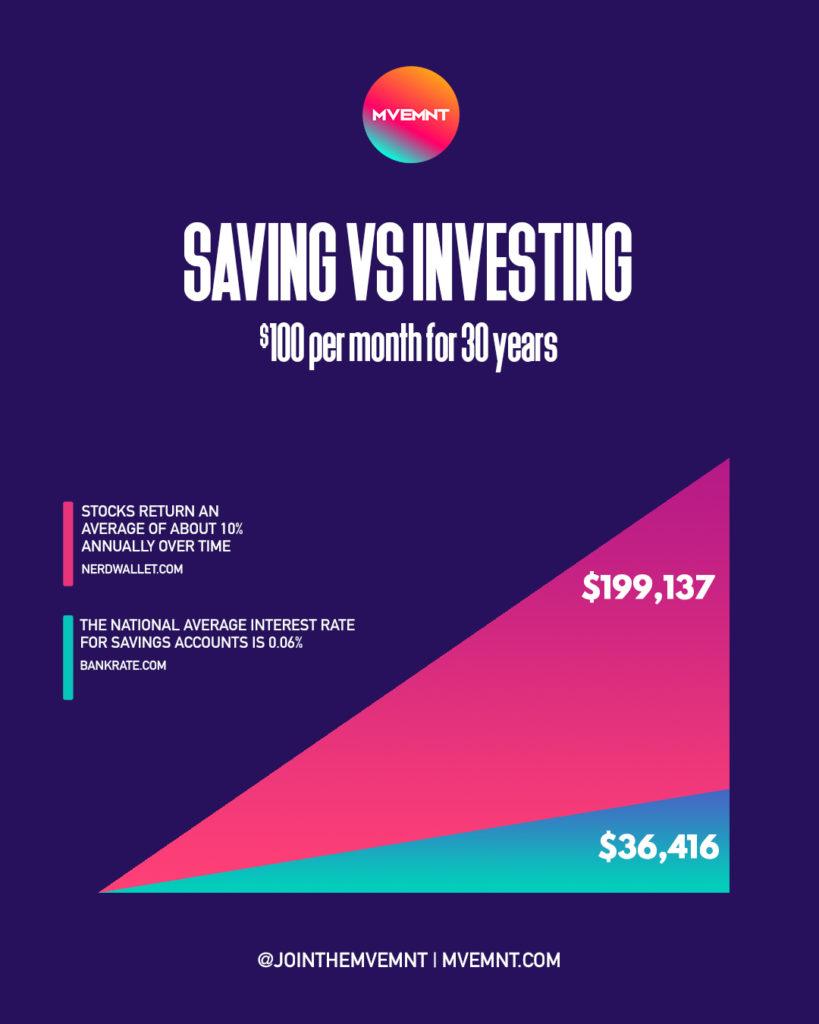

It’s not just about how much you make; more importantly, it’s about how much you keep. You can’t build lasting wealth unless you begin to save and invest. If you follow the above steps, it will be easier for you to do this. Simply making money won’t guarantee you success or that you’ll be wealthy; how you manage your money will determine that. You must have a budget; you must eliminate debt, and you must live below your means. This will position you to save aggressively and begin to build wealth.

TIP #5: BE GENEROUS

You could argue that there is no better feeling than helping those less fortunate than yourself. One of the great things about being wealthy is that it allows you to share your wealth with others. Being generous is a powerful thing that moves your perspective from one of scarcity to one of abundance, and if nothing else, it just feels great to give back! The more you give, the more you get!

There is a reoccurring theme in achieving your financial goals, and it’s the importance of saving and investing. African Americans have $1.6 trillion in spending power annually, and we spend it; however, we should save and invest it.

“African Americans have $1.6 trillion in investing power annually.” Sounds better!